Is Credit Training legal?

Yes, credit training is legal and our credit education and document processing services will help you to use the law in your favor. That law is called "The Fair Credit Reporting Act." The FCRA gives you the right to dispute any item on your credit report. If that item cannot be verified within a reasonable time (usually 30 days) it must be removed. Studies have shown that 79% of all credit reports contain errors. This is nearly 8 out of 10 reports. Therefore most credit reports improve immediately. For items that disputed that are not errors, a creditor or furnisher is often unable to find the records or signed documents within the allotted time and the item gets removed. Sometimes the furnisher will say it has been verified by not offer proof. It is our job to prepare documents that challenge this and we are very skilled at that.

Is Credit Training and Education worth my time and money?

Contrary to what credit bureaus want you to believe, credit training does work in most circumstances. But it only works if you are getting the best advice from an experienced professional. Anyone with a credit score below 720 can benefit long-term from the advice and information provided through credit education. However, there are limiting factors that will prevent us from helping you. Two main factors are: (1) your financial situation and/or (2) the time frame in which you need to reach your results. It is possible to remove anything from a credit report, even accurate items. For instance, if the creditor makes mistakes or does not adhere to the specific time frame, the negative item may be removed.

What can I expect when I enroll in Credit Education?

We will guide you through the process from start to finish and prepare all your documents for you. We have a superb knowledge of credit scoring and experience working with creditors and credit bureaus. It may be difficult for an individual to communicate with creditors and bureaus without an adept understanding of their techniques and regulations in place for credit reporting. We have spent a great deal of time learning the laws that will help you to remove negative information on your report, which enables us to offer you a flawless, money back guarantee system.

What is your 100% Guarantee?

You are entitled to a 100% refund of all payments and fees if the following conditions are met:

Cancellation Policy: You may cancel our services at any time. To do so, please provide written notice at least 7 days before your next billing date to avoid being charged for the upcoming month.

- Less than 25% of the negative items we worked on have been removed from your credit reports.

- You have maintained our services for at least six months from the date of enrollment.

- You had at least four negative items on your credit report at the time of sign-up.

- You have not engaged another credit repair agency or attempted to repair your credit yourself within the two years prior to enrolling with us.

- You agree to send updated credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) to us within 5 days of receipt.

- You actively monitor your reports, ensuring you receive updates every 15-45 days and promptly inform us if updates are not received.

Cancellation Policy: You may cancel our services at any time. To do so, please provide written notice at least 7 days before your next billing date to avoid being charged for the upcoming month.

What type of results can I expect?

Every credit situation is unique—some cases are straightforward, while others are more complex. We understand that most people want to know what they can realistically expect. At 369 Credit Management, we believe in complete transparency.

Through our services:

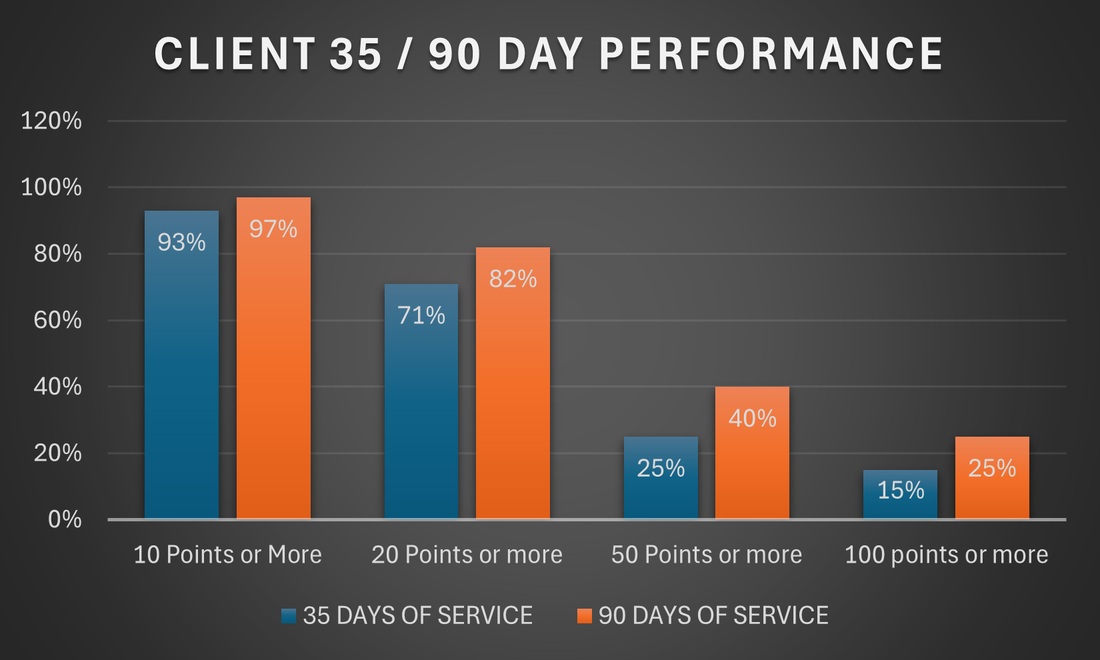

This graph demonstrates how quickly improvements can happen:

Through our services:

- 93% of clients see a credit score increase of 10 points or more in just 35 days.

- Within 90 days, over 40% of clients experience an increase of 50 points or more.

- Over the 180-day contract period, the average credit score increase is 80 points.

This graph demonstrates how quickly improvements can happen:

While results vary based on individual circumstances, our proven approach ensures consistent progress. Take the first step today and let us help you achieve your financial goals!

Why are your results different?

There are two sides to the credit score battle. Sometimes, the creditors and the credit bureaus have done absolutely everything right and we have no case against them. On average, clients are able to remove 70% of the negative items from a credit report.

Will the removed items come back?

Items cannot come back as long as the item is current or paid at the time of removal or if the collection is older than three years. This holds true except in very rare circumstances.

Information that cannot be in a credit report:

- Medical information (unless you provide consent)

- Notice of bankruptcy (Chapter 11) more than ten years old

- Debts (including delinquent child support payments) more than seven years old

- Age, marital status, or race (if requested from a current or prospective employer)

How long will certain items remain on my credit file?

- Delinquencies (30- 180 days): A delinquency may remain on file for seven years; from the date of the initial missed payment.

- Collection Accounts: May remain seven years from the date of the initial missed payment that led to the collection (the original delinquency date). When a collection account is paid in full, it will be marked as a "paid collection" on the credit report.

- Charge-off Accounts: When a delinquent account is sent to a collections company. This will remain for seven years from the date of the initial missed payment that led to the charge-off (the original delinquency date), even if payments are later made on the charge-off account.

- Closed Accounts: Closed accounts are no longer available for further use and may or may not have a zero balance. Closed accounts with delinquencies remain for seven years from the date they are reported closed, whether closed by the creditor or by the consumer. However, the delinquency notation will be removed seven years after the delinquency occurred when pertaining to late payments. Positive closed accounts continue to be reported for ten years from the closing date.

- Lost Credit Card: If there are no delinquencies, credit cards reported as lost will continue to be listed for two years from the date the creditor is contacted. Delinquent payments that occurred before the card was lost are reported for seven years.

- Bankruptcy: Chapters 7, 11, and 12 will remain on one's credit report for ten years from the filing date. A Chapter 13 bankruptcy is reported for seven years from the filing date. Accounts included in a bankruptcy will remain for seven years from the date reported as included in the bankruptcy

- Judgments: Remain seven years from the date filed.

- City, County, State, and Federal Tax Liens: Unpaid tax liens remain for fifteen years from the filing date. A paid tax lien will remain on one's score for 10 years from the date of payment.

- Inquiries: Most inquiries listed on one's credit report will remain for two years. All inquiries must remain for a minimum of one year from the date the inquiry was made. Some inquiries, such as employment or pre-approved offers of credit, will show only on a personal credit report pulled by you.

How Can I Improve My Credit Score?

- Pay All Bills on Time

- Timely payments on all bills—utilities, rent, mortgages, auto loans, and credit cards—are the single biggest factor in maintaining a good score. Consider setting up automatic payments to avoid missing deadlines.

- Manage Your Credit Utilization

- Keep credit card balances below 30% of the credit limit. If possible, aim for 10% or lower for the best results. High balances signal risk to lenders and can hurt your score.

- Pro Tip: Pay off cards multiple times a month to keep balances low.

- Use Your Credit Wisely

- Avoid avoiding credit! Regular credit use and on-time payments build your history. If overspending is a concern:

- Charge only small recurring bills (like Netflix or utilities) to your card.

- Pay the balance in full each month.

- Avoid avoiding credit! Regular credit use and on-time payments build your history. If overspending is a concern:

- Don’t Close Old Accounts

- Length of credit history matters. Keep older cards open, even if unused. Make small purchases on them every few months to keep the account active.

- Check Your Credit Report Regularly

- Review your credit report at least once a year for errors. You’re entitled to a free report from each bureau annually at AnnualCreditReport.com.

- Dispute inaccuracies immediately, as errors can unfairly lower your score.

- Be Patient and Consistent

- Credit improvement is a gradual process. Stick to these steps consistently, and your score will improve over time. Focus on building habits that last.

What items can you help me to remove and improve?

With our assistance and document processing, our clients have had great success with bankruptcies, foreclosures, collections, charge-offs, repossessions, medical bills, credit card debt, inquiries, late payments, old addresses, judgments, tax liens and student loans.

These people had amazing results

|

"I can't express how thankful I am for 369 Credit Management. They didn't just fix my credit; they gave me a fresh start. Their team's professionalism and commitment are unmatched. They not only removed negative items from my credit report but also educated me on responsible credit management. It's like having a personal financial coach. With my improved credit score, I was able to secure a mortgage at a favorable rate, which I thought was impossible just a year ago. Working with them was a turning point in my financial journey."

Callum R. |

"I'm amazed by the results I've achieved with 369 Credit Management. From the beginning, their approach was focused and results-driven. They meticulously reviewed my credit history, identified errors, and effectively communicated with credit bureaus on my behalf. What sets them apart is their commitment to transparency – I was kept informed about every step of the process. The increase in my credit score not only opened doors to better credit options but also boosted my self-confidence. I highly recommend 369 Credit Management to anyone looking to take control of their financial future."

Dave I. |

"369 Credit Management has been a game-changer for me! Before I started working with them, my credit score seemed stuck, and I didn't know where to begin. Their team took the time to analyze my credit reports, identify inaccuracies, and devise a tailored plan. Within just a few months, I saw significant improvements in my credit score. Thanks to their expert guidance, I now have the confidence to apply for better loan rates and credit options. My financial outlook has completely transformed, and I'm incredibly grateful for their dedicated support."

Gloria G. |