What makes up a credit score?

Your credit score is a key factor that impacts your financial opportunities, from loan approvals to interest rates. Whether you're planning a big purchase like a mortgage or simply curious about your credit health, understanding your score is the first step.

A credit score is a numerical value (300–850) designed to predict your creditworthiness. The higher the score, the more likely you are to get approved for loans and favorable terms.

Average Credit Score: The average credit score bottomed out at 686 during the housing crisis, but has been steadily increasing since then. The COVID-19 pandemic caused a further increase, with government stimulus programs and increased household savings contributing to the jump. The average credit score as of April 2024 is 717.

Exceptional Credit: A score above 800 is considered exceptional. While a perfect 850 is rare (only 1.7% of Americans achieved this in 2023), it’s not necessary for excellent benefits.

A credit score of 720 or more is considered excellent, while a score of 620 or lower is considered bad.

Average Credit Score: The average credit score bottomed out at 686 during the housing crisis, but has been steadily increasing since then. The COVID-19 pandemic caused a further increase, with government stimulus programs and increased household savings contributing to the jump. The average credit score as of April 2024 is 717.

Exceptional Credit: A score above 800 is considered exceptional. While a perfect 850 is rare (only 1.7% of Americans achieved this in 2023), it’s not necessary for excellent benefits.

A credit score of 720 or more is considered excellent, while a score of 620 or lower is considered bad.

WHY YOUR CREDIT SCORE MATTERS

A low credit score can:

Why Your Score Matters:

A high credit score can save you thousands of dollars by:

Tip: Check your credit score regularly and take steps to improve it. Small changes can have a big impact!

- Prevent you from obtaining a loan; mortgage, auto, or credit cards

- Prevent you from renting an apartment

- Increase insurance rates

- Even affect job opportunities in certain industries

Why Your Score Matters:

A high credit score can save you thousands of dollars by:

- Lowering interest rates

- Providing better loan terms

- Waiving fees

- Increasing borrowing limits

- Simplifying rental approvals

- Reducing auto insurance costs

Tip: Check your credit score regularly and take steps to improve it. Small changes can have a big impact!

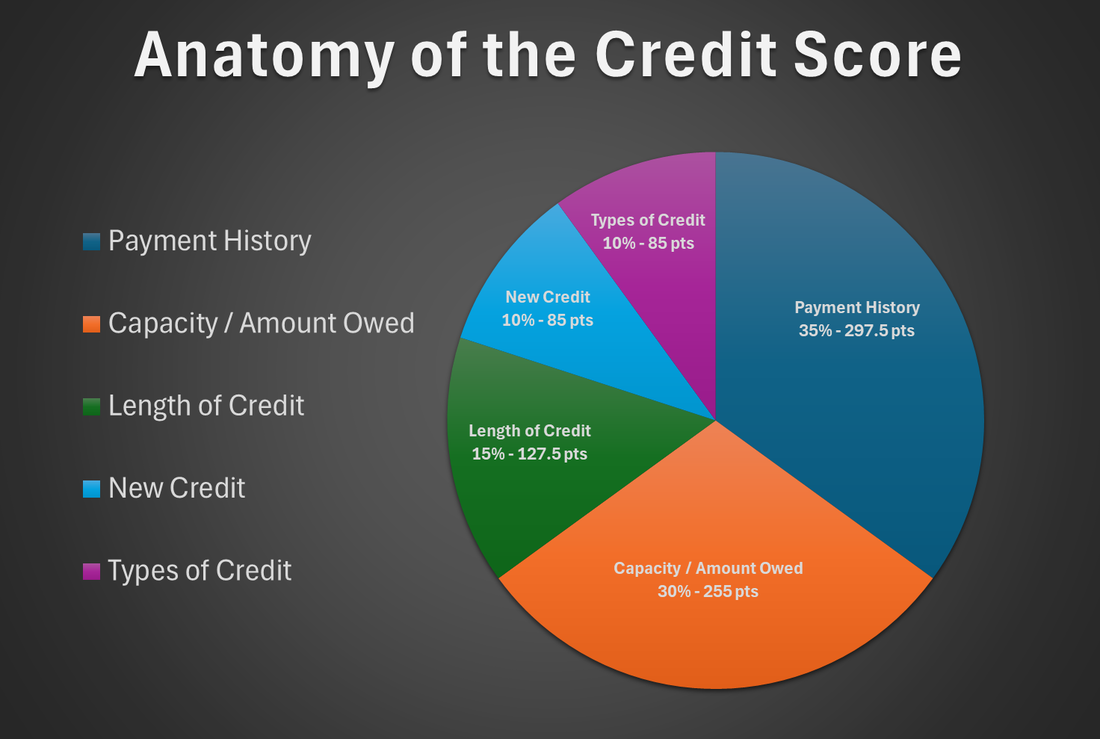

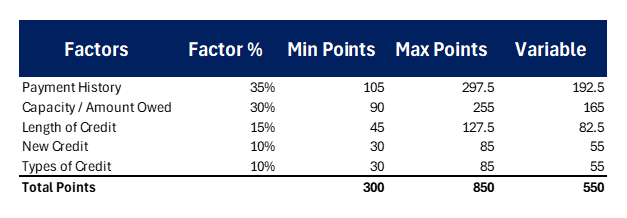

WHAT AFFECTS YOUR CREDIT SCORE?

- Payment History: on-time payments vs. Delinquencies. (More weight on the last 24 months)

- Capacity and Amount Owed: Percentage of credit limits available

- Length of Credit: How long you've had your accounts

- New Credit: Number of inquires and new accounts opened in the last 12 - 18 months

- Types of Credit: Installment loans vs revolving

READY TO TAKE CONTROL?

You may already know your credit needs some work, or maybe you’re preparing for a major financial decision. No matter your circumstances, we’re here to help.

Click below for a FREE credit assessment, and let us guide you toward a stronger financial future.

Click below for a FREE credit assessment, and let us guide you toward a stronger financial future.

HOW WE HELP

- Step-by-Step Guidance: We review your credit report and explain what’s helping or hurting your score.

- Tailored Strategies: Personalized plans to improve your credit.

- Proven Solutions: We help you address inaccuracies, reduce debt, and build better credit habits.

WE HAVE A PROVEN TRACK RECORD HELPING CLIENTS IMPORVE THEIR CREDIT SCORE

If you have a better credit score you could potentially have a better interest rate. Just an increase of 20 point in your credit score can mean a difference of tens of thousands of dollars in interest saved on an average priced home and hundreds of dollars of interest saved on car payments and credit cards. We have a proven track record of helping clients to raise credit scores quickly and effectively to give you better purchasing power.

On average, our clients see a 60 points increase in 6 months.

On average, our clients see a 60 points increase in 6 months.

Our 100% MONEY BACK GUARANTEE / CANCELATION POLICY:

You are entitled to a 100% refund of all payments and fees if the following conditions are met:

Cancellation PolicyYou may cancel our services at any time. To do so, please provide written notice at least 7 days before your next billing date to avoid being charged for the upcoming month.

- Less than 25% of the negative items we worked on have been removed from your credit reports.

- You have maintained our services for at least six months from the date of enrollment.

- You had at least four negative items on your credit report at the time of sign-up.

- You have not engaged another credit repair agency or attempted to repair your credit yourself within the two years prior to enrolling with us.

- You agree to send updated credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) to us within 5 days of receipt.

- You actively monitor your reports, ensuring you receive updates every 15-45 days and promptly inform us if updates are not received.

Cancellation PolicyYou may cancel our services at any time. To do so, please provide written notice at least 7 days before your next billing date to avoid being charged for the upcoming month.

TAKE ACTION AND START TODAY - GET YOUR FREE, NO RISK CREDIT ASSESMENT

These people had amazing results

|

"I can't express how thankful I am for 369 Credit Management. They didn't just fix my credit; they gave me a fresh start. Their team's professionalism and commitment are unmatched. They not only removed negative items from my credit report but also educated me on responsible credit management. It's like having a personal financial coach. With my improved credit score, I was able to secure a mortgage at a favorable rate, which I thought was impossible just a year ago. Working with them was a turning point in my financial journey."

Callum R. |

"I'm amazed by the results I've achieved with 369 Credit Management. From the beginning, their approach was focused and results-driven. They meticulously reviewed my credit history, identified errors, and effectively communicated with credit bureaus on my behalf. What sets them apart is their commitment to transparency – I was kept informed about every step of the process. The increase in my credit score not only opened doors to better credit options but also boosted my self-confidence. I highly recommend 369 Credit Management to anyone looking to take control of their financial future."

Dave I. |

"369 Credit Management has been a game-changer for me! Before I started working with them, my credit score seemed stuck, and I didn't know where to begin. Their team took the time to analyze my credit reports, identify inaccuracies, and devise a tailored plan. Within just a few months, I saw significant improvements in my credit score. Thanks to their expert guidance, I now have the confidence to apply for better loan rates and credit options. My financial outlook has completely transformed, and I'm incredibly grateful for their dedicated support."

Gloria G. |